EITC Scholarships – The Gift of Education with a Tax Advantage

What is EITC?

The Educational Improvement Tax Credit (EITC) Program provides credits to eligible businesses contributing to one of the following specific programs: a Scholarship Organization, an Educational Improvement Organization, and/or a Pre-Kindergarten Scholarship Organization.

TFEC is eligible to receive funds for the Opportunity Scholarship Tax Credit Program (OSTC).

Opportunity Scholarship Tax Credit Program (OSTC)

TFEC will provide tuition to eligible students who reside within the attendance boundary of a low-achieving school to attend a participating nonprofit school or a participating private school located in a school district outside of the recipients’ school district of residence as well as special education schools. Tuition to be paid will include school-related fees charged by a school. TFEC will provide tuition to students in the south-central PA counties of Cumberland, Dauphin, Franklin, Lebanon, Northern York, and Perry. Eligible students are ages K – 12, or the age at which they graduate from a secondary school, with financial need as determined by the DCED guidelines. Families apply for funds through an application process managed by TFEC team members.

How Can I Participate as a Business?

Eligibility

Businesses authorized to do business in Pennsylvania who are subject to one or more of the following taxes:

-

- Corporate Net Income Tax

- Capital Stock Foreign Franchise Tax

- Bank Shares Tax

- Title Insurance and Trust Companies Shares Tax

- Insurance Premiums Tax excluding surplus lines, unauthorized, domestic, foreign and marine

- Malt Beverage Tax

- Mutual Thrift Tax

- Personal Income Tax

- Surplus Lines Tax

Uses

Tax credits may be applied against the tax liability of a business for the tax year in which the contribution was made.

Funding

Tax credits equal to 75 percent of its contribution up to a maximum of $750,000 per taxable year. Can be increased to 90 percent of the contribution, if the business agrees to provide the same amount for two consecutive tax years.

Terms

An approved company must provide proof to DCED within 90 days of the notification letter that the contribution was made within 60 days of the notification letter. Tax credits not used in the tax year the contribution was made may not be carried forward or carried back and are not refundable or transferable.

How Can My Businesses Apply?

- Pennsylvania businesses can begin applying for EITC credits through the Pennsylvania Department of Community & Economic Development’s electronic single application system.

- Application takes less than 10 minutes

- New business applications are due on July 3, 2023

- The Business Application Guide explains the process of applying. Tax credit applications will be processed on a first-come, first-served basis by day submitted.

- All applications received on a specific day will be processed on a random basis before moving on to the next day’s applications. Applications will be approved until the amount of available tax credits is exhausted.

- Applications can be found at the PA DCED’s website

Resources

- EITC Information page

- OSTC information page

- Go to dced.pa.gov/eitc and click “apply” at the top of the page.

Contact Information

If you have any questions, please contact Jennifer Doyle, Vice President of Philanthropy & Community Investment at 717.236.5040 or jdoyle@tfec.org.

Impact

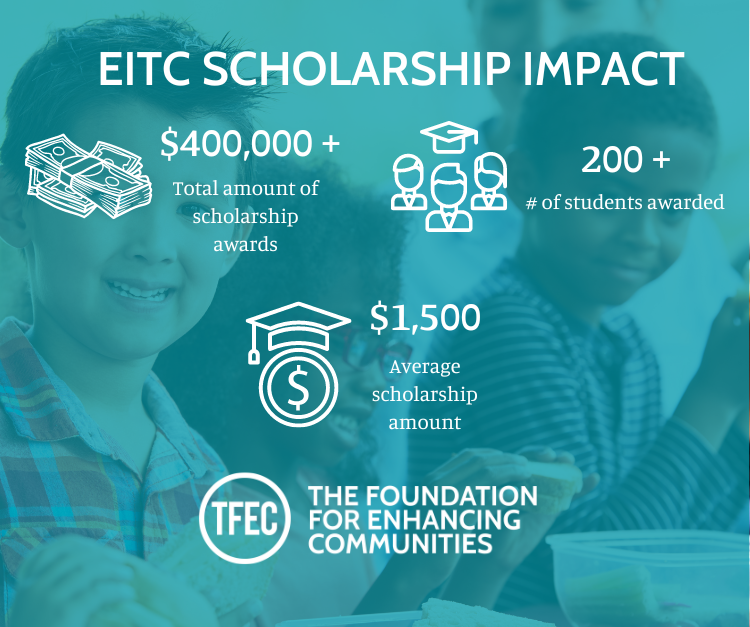

Over $400,000 has been granted to more than 200 students averaging $1,500 per award through the EITC Scholarship program.