It’s no secret that 2020 was a year with constant hurdles, adjustments, and perseverance. Nonprofits faced unique challenges while navigating the “new normal” and serving those in our most vulnerable communities. But the economic impacts of COVID had them fighting to keep their doors open. The pandemic forced the entire nonprofit sector to find unique ways to connect with their donors and fulfill their mission, and forced donors to find different ways to give and support their favorite charitable goals. Gone were the days of large in-person fundraisers, galas, and charity auctions; donors and nonprofits needed something different.

It’s no secret that 2020 was a year with constant hurdles, adjustments, and perseverance. Nonprofits faced unique challenges while navigating the “new normal” and serving those in our most vulnerable communities. But the economic impacts of COVID had them fighting to keep their doors open. The pandemic forced the entire nonprofit sector to find unique ways to connect with their donors and fulfill their mission, and forced donors to find different ways to give and support their favorite charitable goals. Gone were the days of large in-person fundraisers, galas, and charity auctions; donors and nonprofits needed something different.

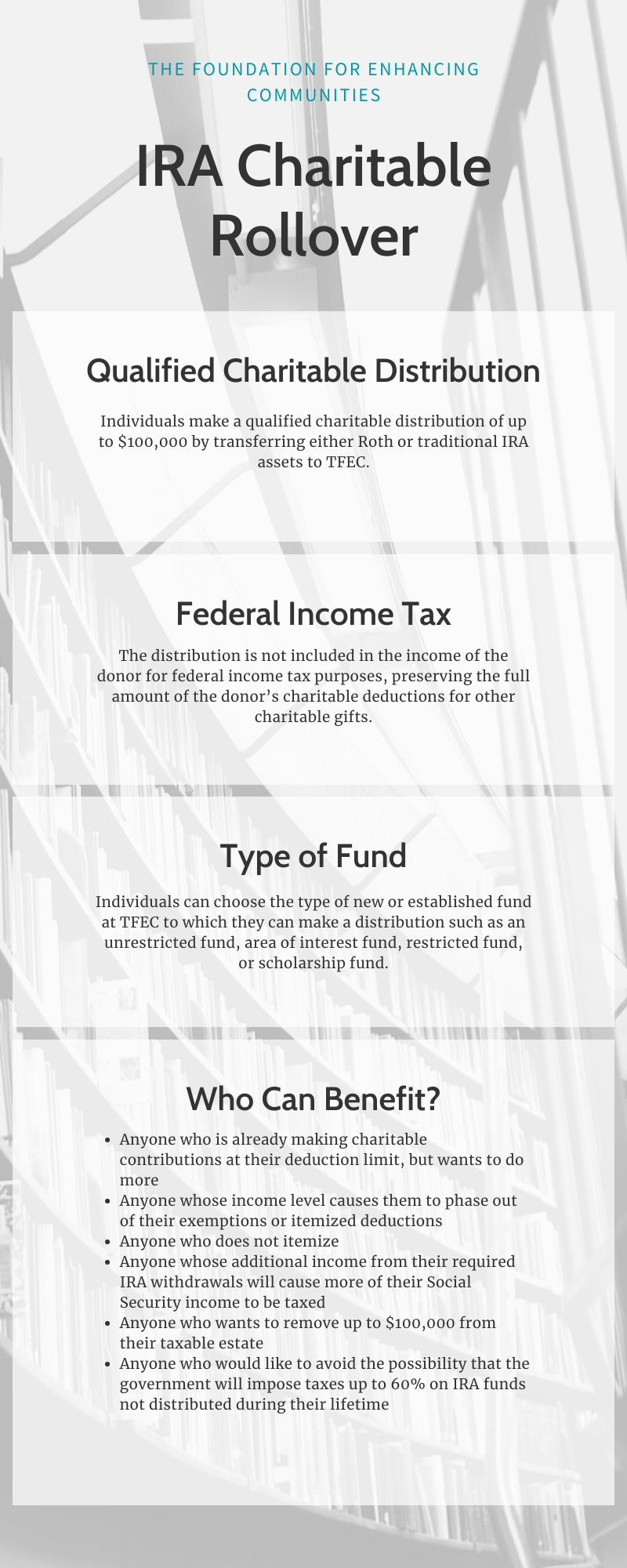

Have you ever considered giving with an IRA Charitable Rollover?

On December 18, 2015, Congress passed the PATH Act. As part of the PATH Act, legislators passed a permanent extension of the IRA charitable rollover legislation, making it easier for Americans to give to causes they care about. The IRA charitable rollover provision, first enacted in 2006, has the power to help local charities strengthen their communities by allowing individuals to roll over up to $100,000 from an Individual Retirement Account (IRA) annually to charity without being federally taxed.

Some other features of note for all donors considering an IRA charitable rollover:

Individuals may also use other retirement assets such as 401ks, 403bs, etc. but must first roll those assets into an IRA to participate in the benefits of an IRA charitable rollover without tax implications.

This provision makes it possible for donors to establish funds now during their lifetime, rather than through their estate plan, allowing them to see the positive effect on the community they love now.

At TFEC, we want to partner with our donors to help them achieve their charitable goals and make the most impact on their local communities. For more information or if you are interested in giving with your IRA, contact Janice Black, President & CEO, or Jennifer Doyle, Vice President of Philanthropy & Community Investment.